Can You Buy Partial Bitcoin? A Guide to Stacking Sats

Yes, you can buy partial Bitcoin. This is the most practical way for most people to start stacking sats, Bitcoin's smallest unit. One Bitcoin divides into 100 million satoshis (sats), allowing you to acquire fractions as small as needed. This divisibility lets everyday users build holdings over time, promoting real financial sovereignty without buying a whole coin upfront. For instance, consistent weekly buys through dollar-cost averaging (DCA) can grow your stack meaningfully by smoothing volatility. Use the DCA calculator below to input your buy amount and start date, see past performance, and forecast potential growth.

Click anywhere on the chart to change the DCA start date

DCA Periods

264 weeks

Start Date

Jan 2021

End Date

Jan 2026

Click on chart to change DCA start date

What Are Satoshis?

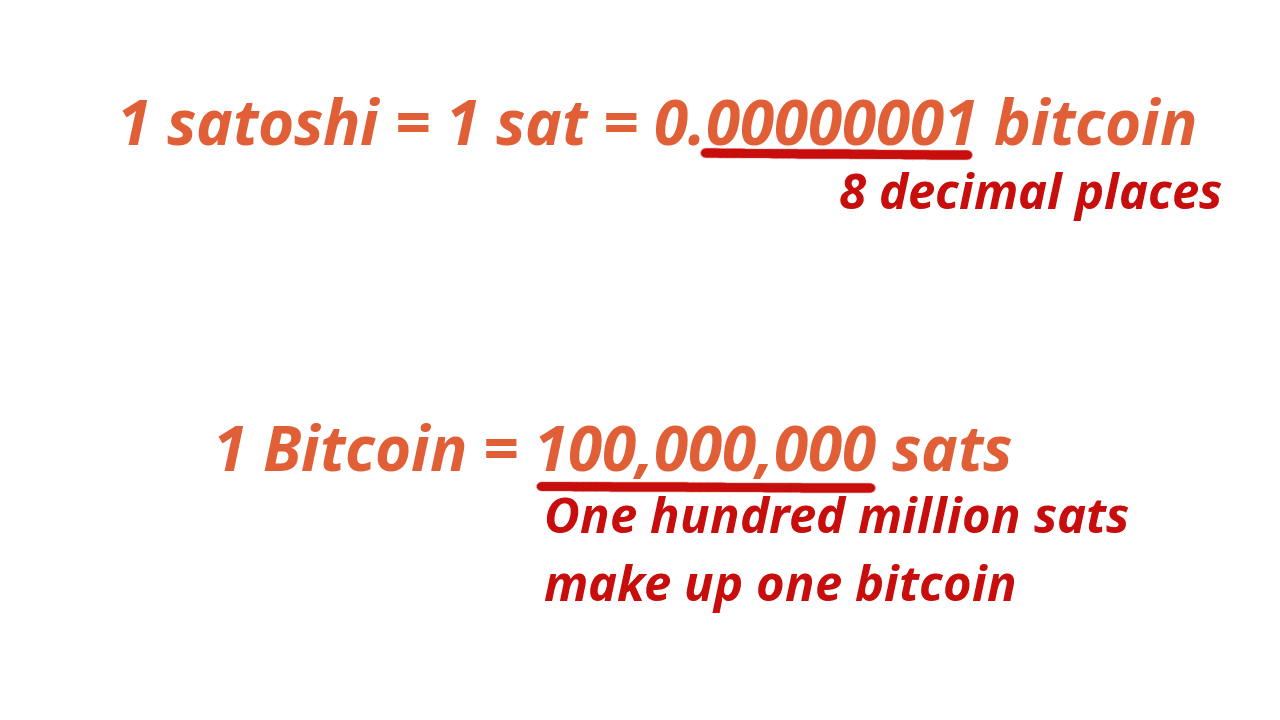

Satoshis are bitcoin. A satoshi, or "sat" for short, is the smallest indivisible unit of bitcoin, making it possible to own and transact tiny fractions of a bitcoin. Think of it like the US dollar, which breaks down into 100 cents to allow for small transactions. Bitcoin does the same, but on a grander scale. One satoshi equals 0.00000001 bitcoin (8 decimal places), meaning there are 100,000,000 satoshis in a single bitcoin. This divisibility is a key feature of Bitcoin's design, allowing anyone to buy fractions of a bitcoin and build their wealth. The name honors Satoshi Nakamoto, the creator of Bitcoin.

How to Buy Partial Bitcoin: 3 Simple Steps

New to Bitcoin and want hands-on support for your first purchase? Book a free introductory call with me. I'll guide you step by step through buying sats and securing them in self-custody, empowering you to take full control from day one.

1. Choose a bitcoin exchange and sign up

When choosing a platform to buy Bitcoin, only consider those that enable withdrawals to your own wallet. Since January 2025, I've been buying my bitcoin from River, a bitcoin only company. They offer zero-fee recurring buys, which are perfect for my DCA strategy. Sign up with my link and we both will receive 5$ in bitcoin when you buy your first 100$ of bitcoin.

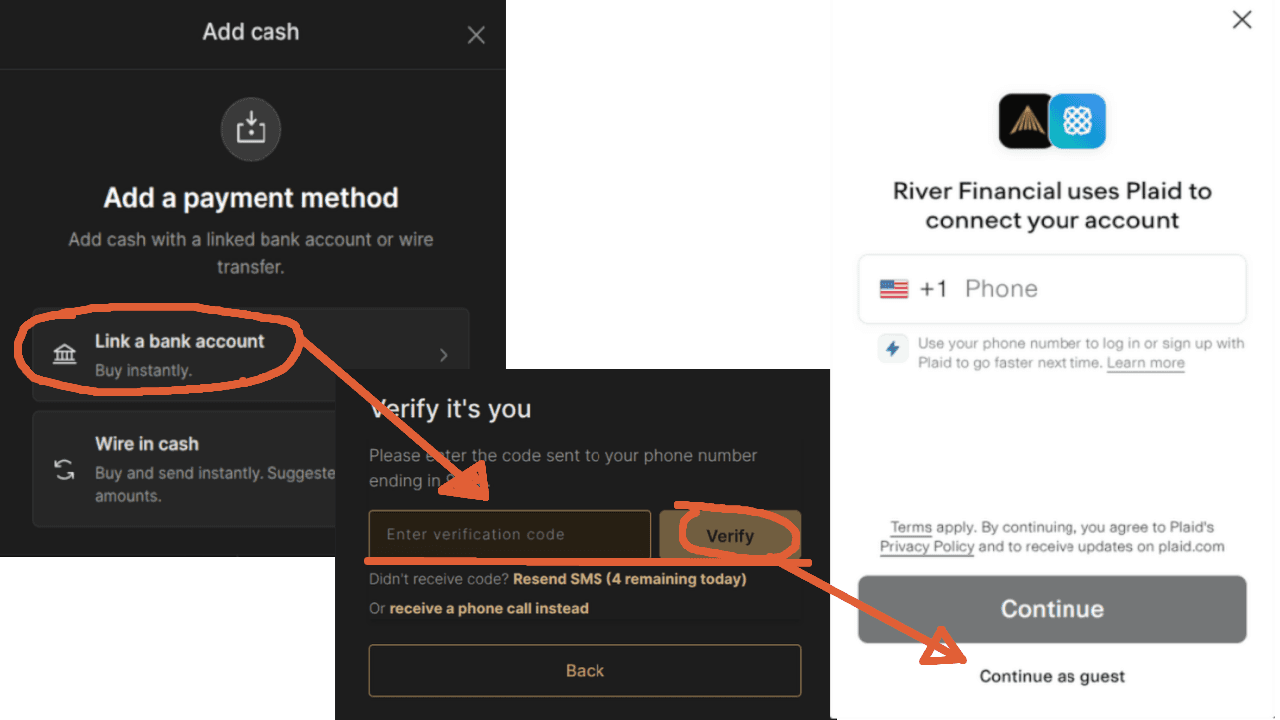

2. Link a bank account

Linking a bank account is a straightforward process on most reputable Bitcoin exchanges, allowing you to fund your purchases securely via ACH transfer or similar methods. Start by navigating to the 'Funding' or 'Deposit' section in the app or website, then select your bank and follow the prompts. You'll often use a secure service like Plaid to connect your account. You'll typically need to verify the link through a one-time code sent via SMS or email. For a detailed walkthrough using River, check out my dedicated post here, complete with screenshots like the one below.

3. Buy Bitcoin

Buying Bitcoin is the easiest part. Navigate to the 'Buy' or 'Trade' section, select Bitcoin as your asset, choose a market order, and enter the amount you want to spend - even just a few dollars worth. Execute the order. Congratulations! You've just acquired a partial Bitcoin! To build long-term wealth, adopt a dollar-cost averaging (DCA) strategy. For details on setting up zero-fee DCA with River, check out my guide here.

How to Properly Store Your Bitcoin with Self-Custody

Remember the golden rule: not your keys, not your bitcoin. Once you've bought your partial bitcoin on an exchange, true ownership means taking control of it yourself. Leaving it there is just an IOU from a third party, vulnerable to hacks, freezes, or worse. Bitcoin stands alone in offering genuine digital self-custody, empowering you to hold your wealth without relying on banks or middlemen. Here's how to secure it in three straightforward steps.

1. Create a bitcoin wallet

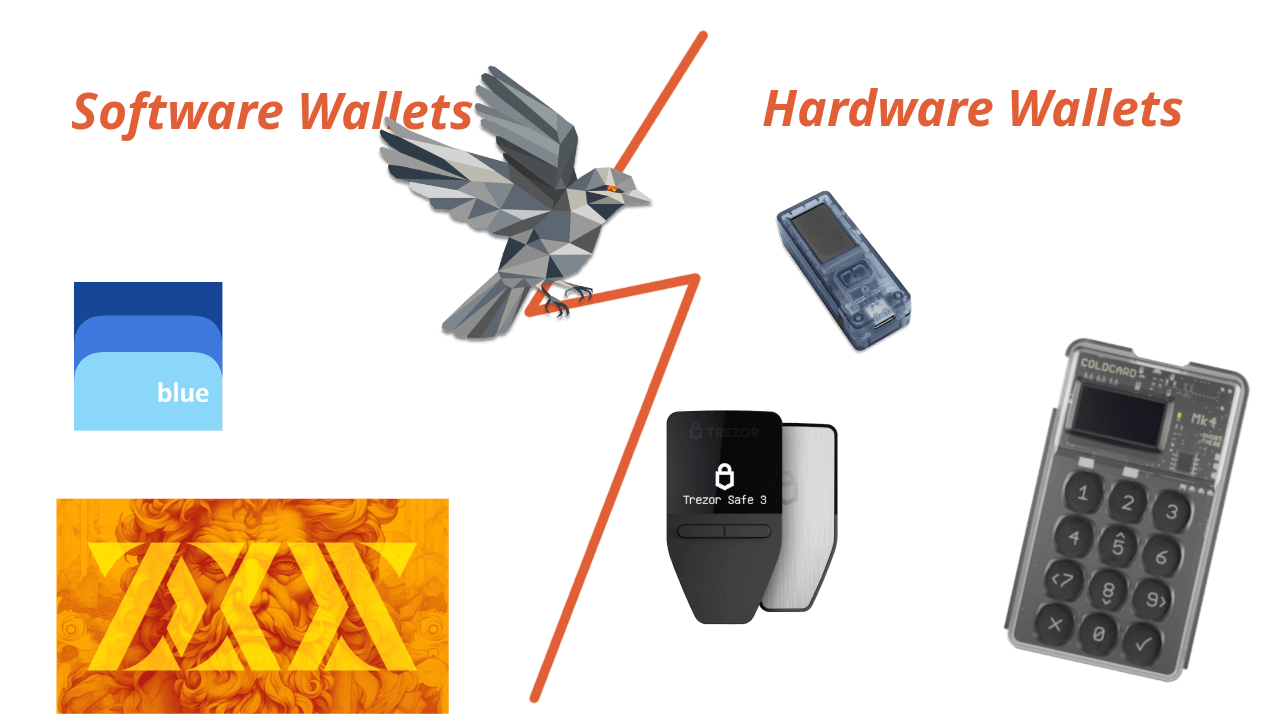

There are many bitcoin wallets on the market, but they fall down into 2 main categories: hardware wallets, and software wallets.

Hardware Wallets

Hardware wallets (or cold wallets) are dedicated devices that stay offline for maximum security. They look like small USB drives or other compact gadgets and only connect to your computer briefly when you need to send Bitcoin, keeping your private keys protected from hackers. The hardware wallets I recommend, the Coldcard MK4 or Coldcard Q, are optimal because they support air-gapped operation. This means no data ever passes through a live connection. Instead, all data moves physically via SD card or QR scanning. For more on air-gapped security and the Coldcard, see my dedicated post here.

Software Wallets

Software wallets (also known as hot wallets) connect to the internet, making them convenient for everyday use on your phone or computer. These are apps or programs that run on internet-enabled devices, letting you manage your Bitcoin quickly but with higher exposure to online risks. Sparrow Wallet is my go-to software wallet. It's free and open source, and it works with my favorite hardware wallet (in airgap) and also allows you to create software wallets on the fly for free. For a step-by-step guide to setting up your first Sparrow Wallet, check out my post here.

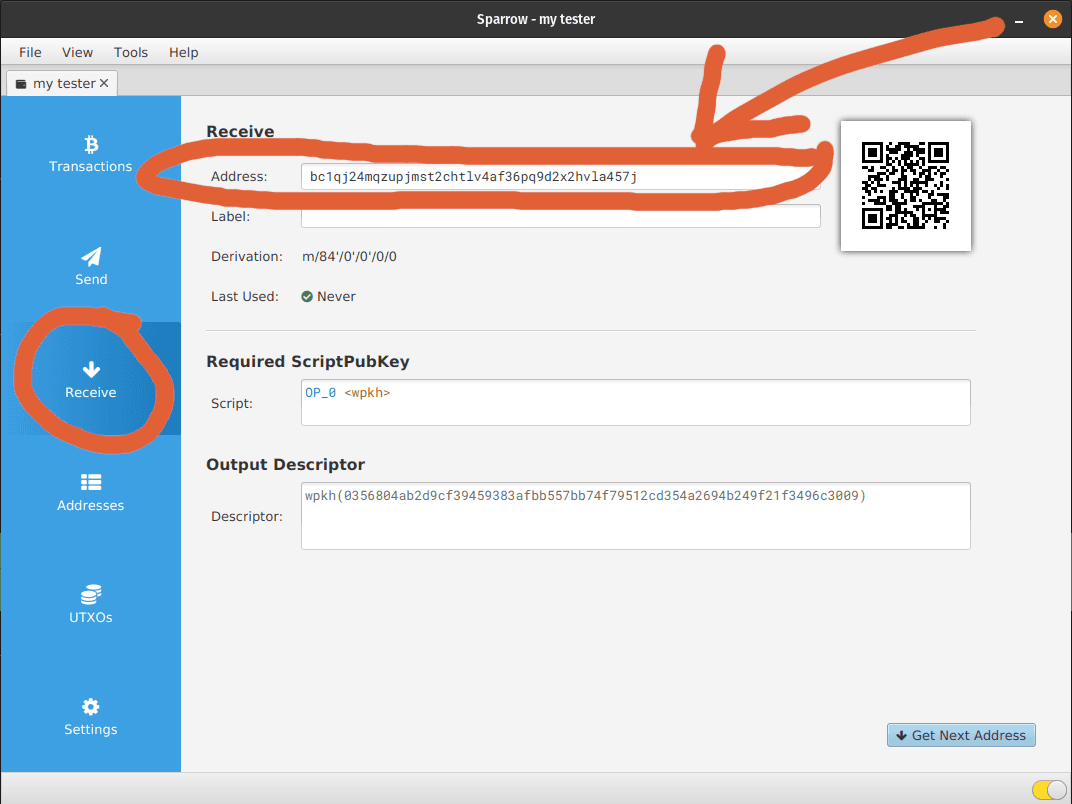

2. Generate a Receive address

Whether you're using a software wallet or a hardware wallet, you'll access balances and generate receive addresses through the wallet's software interface. Navigate to the 'Receive' section in your wallet app and select it. This will generate and display a fresh Bitcoin receive address. For better privacy, use a new address for each incoming transaction. Copy this address securely - it's the destination for transferring your Bitcoin from the exchange to your self-custodied wallet.

3. Withdraw your bitcoin from the exchange to your wallet

Withdrawing is the act of sending your bitcoin from the exchange to an account you control - your own self-custody wallet. This step transfers true ownership to you, free from any third-party risks. On the exchange platform, locate the 'Withdraw' or 'Send' option, often in the menu, sidebar, or portfolio section. For River, tap the 'Send Bitcoin' button in the app's main dashboard or under your bitcoin balance. On Coinbase, click 'Send Crypto' from the sidebar navigation. Paste the receive address you generated in your wallet from the previous step into the destination field. Double-check the address to avoid errors, then enter the amount of bitcoin to withdraw (even fractions count toward stacking sats). Confirm the transaction with any required verification, like two-factor authentication, and hit send. Fees may apply, so review them first. Once confirmed on the blockchain, your partial bitcoin is now securely in your possession, ready for long-term holding.

Need personalized guidance? I offer focused 1-on-1 education to help you master self-custody, wallet setup, node running, and secure Bitcoin practices like a pro. Book a free 15-minute call to start.

The Bitcoin HODL Mentality

Bitcoin's price swings make it tough to predict highs or lows, yet the smartest approach is steady accumulation through regular purchases. Fiat currencies erode in value over time due to endless printing, while Bitcoin's fixed supply of 21 million coins ensures its scarcity. Protect what you acquire by self-custodying in your own hardware wallet, swapping depreciating paper for the most robust, energy-secured asset on the planet.

Stay humble and stack sats.

FAQ

Can you buy less than 1 bitcoin?

Yes! You can buy fractions of a bitcoin, called satoshis, on any reputable bitcoin exchange.

How Do I Secure My Partial Bitcoin?

Secure your partial Bitcoin through self-custody in a hardware wallet like the Coldcard MK4. This gives you full control of your private keys and eliminates risks from exchanges or custodians. For enhanced air-gapped security, consider the MK4 Nomad.

What’s the Best Way to Buy Partial Bitcoin?

The best way to buy partial Bitcoin is through a reputable, Bitcoin-only exchange that supports fractional purchases starting with just a few dollars. This approach lets you stack sats via dollar-cost averaging and withdraw directly to your self-custody wallet for true ownership.

Why Should I Use Self-Custody for Bitcoin?

Self-custody gives you full control over your Bitcoin by managing your own private keys, eliminating reliance on exchanges or third parties that could freeze, hack, or misuse your funds. Without it, you're trusting custodians who have a history of failures, like lending out Bitcoin for yield and being unable to return it during crises such as the FTX collapse. Embrace self-custody to safeguard your financial sovereignty and avoid becoming a victim of systemic risks in traditional finance.

What do I do if I need help?

If you need help along the way, book a free 15-minute session for one-on-one Bitcoin education. I'll guide you through self-custody setup and key practices to become your own bank.