Bitcoin is safer than Real Estate

In the following post, I'll go over why I think bitcoin is a superior long-term investment than real estate. If you primarily own real estate, I hope this post gets you thinking about the real risks you face, risks that bitcoin is immune from. Let's go.

Setting the stage

Before we can get into it, it's first important to set the stage. I don't intend this to be political or anything of that nature. What I intend to do is ground the reader, you, into the ugly reality of modern America.

It feels right to start with inflation and the upcoming US presidential election taking place in a couple weeks.

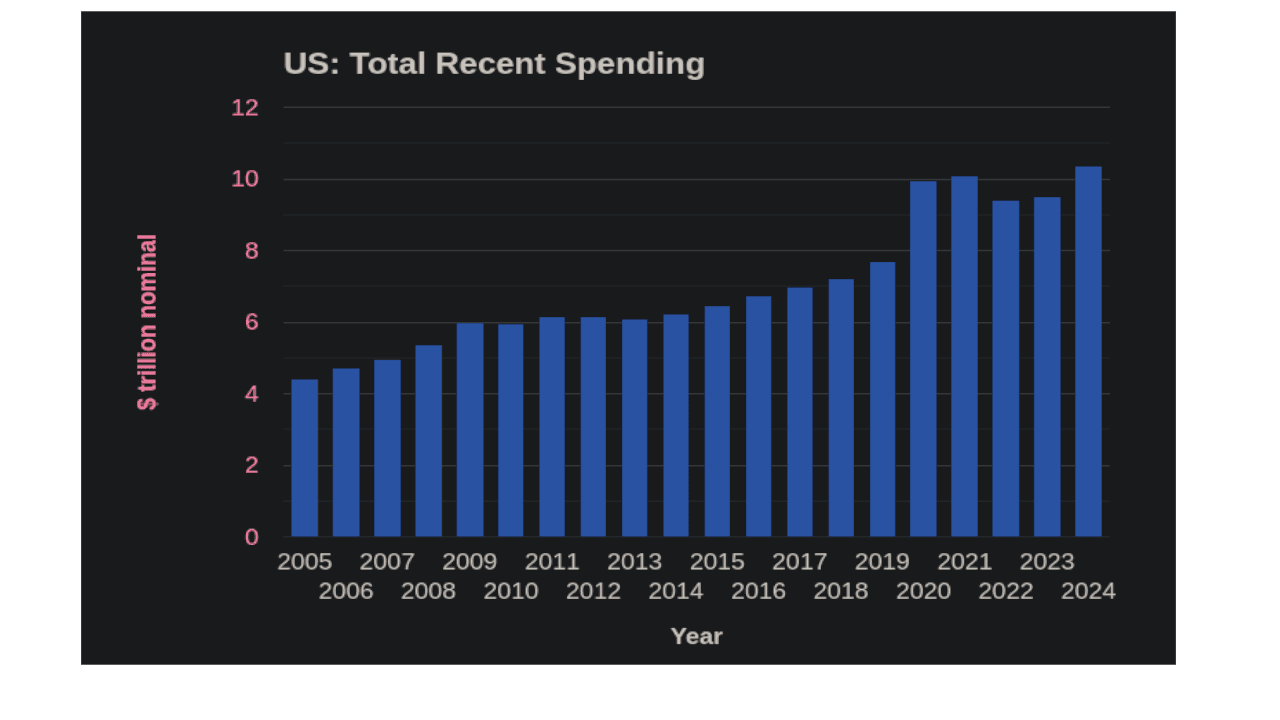

Despite whoever wins the election, we can expect government spending to increase. This has been the case in the past, whether the sitting president was a republican or a democrat, government spending has only risen, constantly setting new record highs.

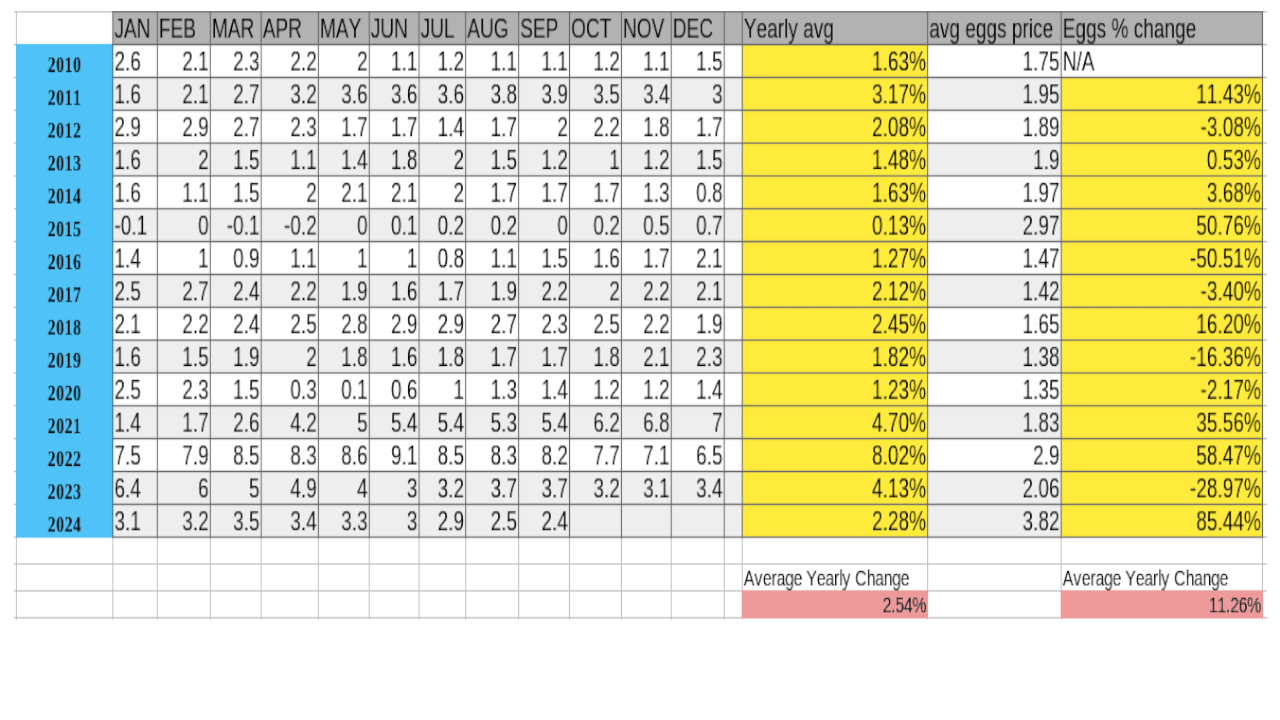

Regardless of the spending, the Federal Reserve does it's best to maintain the illusion that inflation is around 2%. In reality, inflation is somewhere around 10-20%, but the fed hides this by changing the "basket of goods" that they use when determining the inflation rate.

The real inflation rate can still be seen in real goods, like healthy foods and energy.

The chart below shows the reported inflation rate side-by-side with the price of a dozen eggs in USD. Here you can get a better measure for the real inflation rate. I'm sure you can also feel it every time you fill up your car or go grocery shopping.

Ok, so how did it get to this point?

The government often runs a deficit, spending more money than it collects in taxes. To finance this deficit, the government issues bonds, which it has to repay with interest.

When it's time to service these bonds, the government doesn't magically create more money, so it raises revenue through taxes and sometimes additional borrowing. The Federal Reserve then has to buy these bonds with newly printed money if no one else does.

Historically, foreign entities have purchased U.S. Treasury securities as part of their foreign reserves strategy. However, geopolitical actions, like sanctions on Russia, have made it known to the world that we can and will weaponize our currency. Now, other large countries are ditching the dollar since they know it can be weaponized against them. All this to say, the federal reserve will have to print even more money to buy these bonds, increasing the rate of inflation even more.

The effects of Inflation on a Country

Some leaders, like Donald Trump, have called inflation a "country buster."

To see how inflation got this name, one does not need to look too hard as history is full of examples. For starters, the top 10 richest countries of any time period are constantly changing decade to decade. These once rich nations before us, like Rome, Argentina, and Lebanon, just to name a few, all go down in the same way. They inflate themselves to death.

Their leaders make bad decision either through incompetence or corruption, and eventually, with no stable currency to keep the fabric of society intact, it begins to decay.

.jpg&w=3840&q=75)

Think about it this way. Pre-1910's Argentina was one of the richest countries. Now, we look at it in a not so positive light. As an American, when I think about Argentina, the first things I think about are "crime", "third world country", and "corruption." Empires like Rome, Portugal, Spain, British, etc have all once been at the top of the world at one point, and people of their time would've been hard pressed to believe that one day they they'd lose it all.

What makes anyone think that America is immune from this? We know inflation is a big problem, we can feel it already. And cracks in society have been showing for some time now. Crime is increasing, corruption is blatant to those paying attention (Nancy Pelosi, etc), and society is struggling with basic biology.

So, with the stage set, lets briefly go over the risks you face with investment real estate that bitcoin is immune is from.

Threat of Inflation and Societal Decay

As we alluded to above, inflation, which is happening now, is a huge threat to real estate investors. Inflation makes it harder for tenants to find work and pay rent, leaving more work for the landlord since now they need to go through the eviction process and find a good replacement tenant.

The rise of evictions also raises the threat of property damage, which can be devastating to your portfolio. More evictions will also increase the likelihood of local homelessness and crime, devaluing your property value.

Threat of Government Overreach

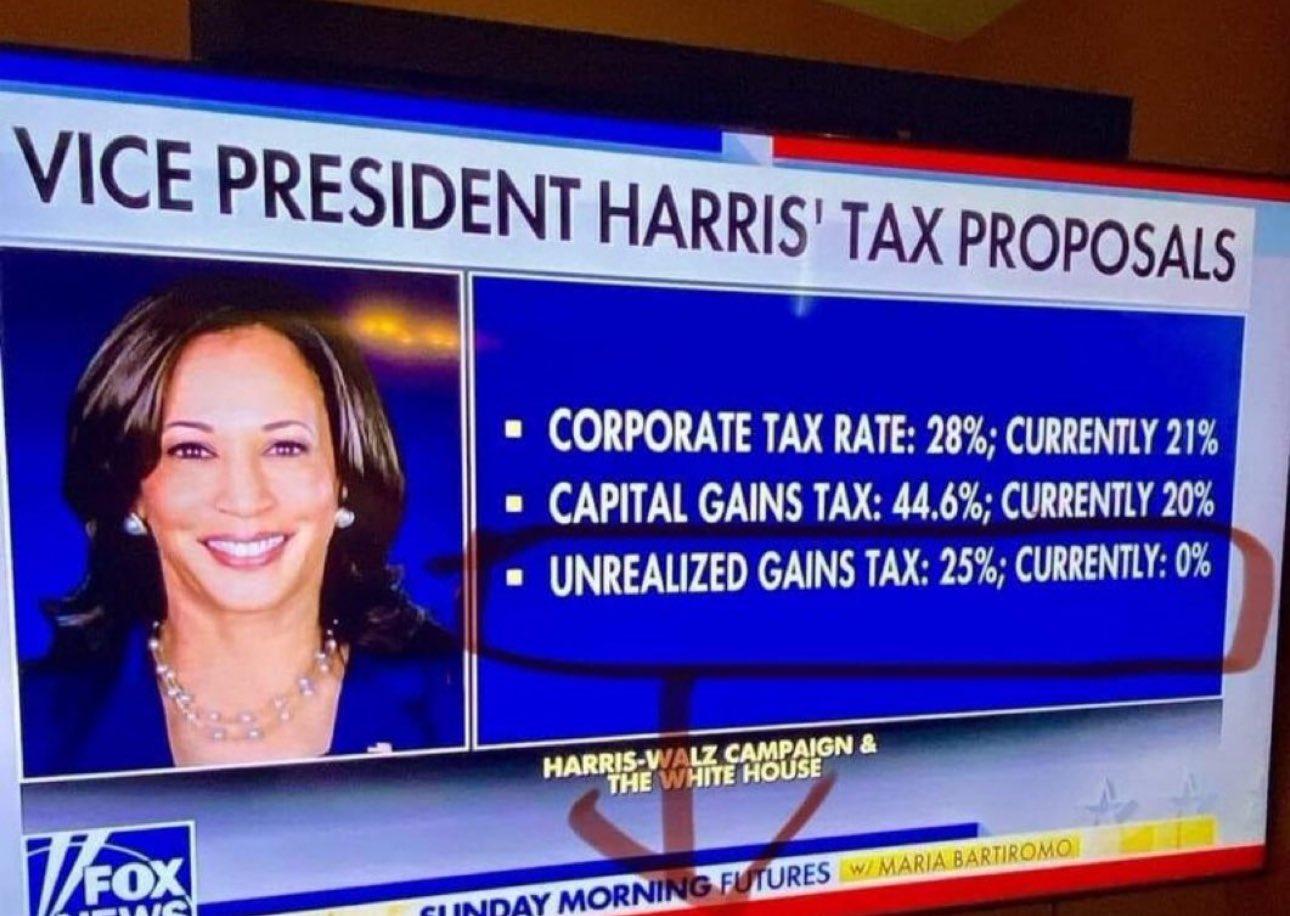

With inflation ravaging a country, the odds of government corruption and overreach increases. One of the governments favorite solutions to everything is to just increase taxes. Who's to stop the government from raising property taxes so exorbitantly, that you can no longer afford it, and thus allows their banker buddies to buy your assets at auction? Kamala Harris is already talking about an unrealized capital gains tax which would totally kill real estate as an investment.

This is not even mentioning government seizure. Eminent domain is something most of us have forgotten about, but talk to someone older and they all have stories. You don't have to worry about this with bitcoin.

Threat of Violence

Bad policy, inflation, and social unrest also increase the threat of violence. The 2020 riots in America showed us that our streets are not safe from even our own citizens. Property damage was rampant, and many business and property owners lost everything.

Also, the Biden/Harris policy of open borders has let in some of the worst people into our country. In Colorado, Venezuelan gangs have been wreaking havoc, taking over entire apartment complexes by force and threatening the property owners with violence.

Bitcoin cannot be taken by force.

Threat of Natural Disasters

Acts of God are also very real threats. Real estate investors with their assets in parts of Florida and North Carolina have recently lost it all after hurricanes swept through. Imagine working your whole life, building a substantial portfolio only for a random hurricane to come and take it all, undoing your life's work. This is the reality for a lot of people. Insurance companies may help, but they're not in the "giving away money" business, so expect a headache, if anything.

Threat of the Asset itself

And finally, real estate is a depreciating asset. Think about it. It's just rotting lumber on a plot of land. There are maintenance costs associated with it, plus housing is not scarce. More houses can be built.

Real estate maintains the illusion of a good investment because of the inflation of the dollar and the relative strength of private property rights in the US, but due to the reasons outlined earlier in this post, I think it's quite dumb to believe that your private property rights will always be there. At the end of the day, if you cannot exert control over your property or rely on someone else to (which is enforced with violence, what business did you think the government was in?), then it's not your property.

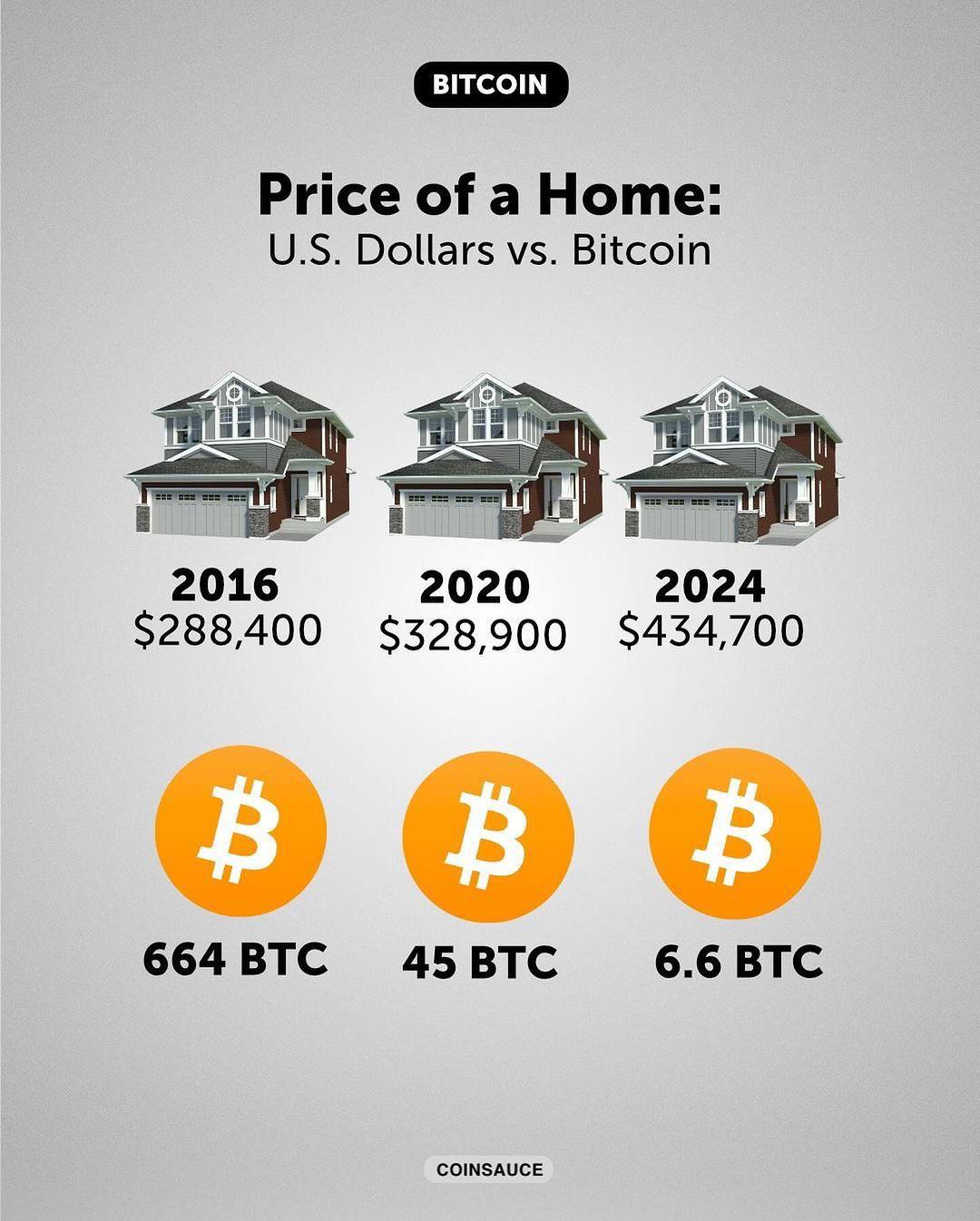

Bitcoin is demonitizing real estate

The reasons above are just one angle why people like myself have fallen in love bitcoin. It is the perfect asset to carry across generations. Bitcoin is also in the process of demonetizing real estate. As smarter investors are starting the realize the power bitcoin gives you, they are starting to de-risk, by selling their real estate for bitcoin.

Why would anyone hold real estate when bitcoin offers superior protection, at a cheaper cost? The only answer I can come up with is knowledge. Smart and successful people of the past have a hard time seeing where the world is headed, and are often caught in the mentality of "it's worked for me for so long, I'm gonna keep doing what I know," when in reality, the world is changing fast, and strategies are always changing.

Real estate traps you. It's not liquid, there's tons of regulations, it's physical, and time consuming.

Adopt bitcoin into your strategy and feel real freedom.